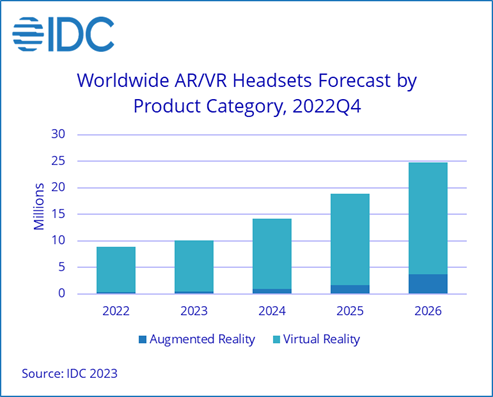

According to IDC Research the growth for AR and VR headsets is slowing down in 2023. This prediction is based on the weaker than expected 2022. Still, the global shipments is expected to reach an amount of 10.1 millions of headsets, based on the Worldwide Quarterly Augmented and Virtual Reality Headset Tracker. Also, the research firm expects a compounded growth of 32.6% for the next five years.

IDC Research has lowered its forecast for augmented and virtual reality (AR and VR) headsets in 2023, due to the weaker than expected number of shipped headsets in 2022. They expect that 10.1 million units will be shipped in 2023. That is a growth of 14% compared to 2022. But the research firm is expecting an acceleration over the 2023-2027 forecast period with a five-year compound annual growth rate (CAGR) of 32.6%.

IDC Research: new devices create momentum

Jitesh Ubrani, research manager of Mobility and Consumer Device Trackers at IDC Research says: “The challenging macroeconomic climate is largely to blame for this year’s lowered expectations, although it will not impact all vendors equally. Sony’s new PSVR2 and Apple’s foray into the space will help drive additional volume while new devices from Meta and Pico, expected towards the end of 2023, will build momentum for VR in 2024. Meanwhile, on the AR front, consumer-facing brands such as Xiaomi, Oppo, and TCL are all expected to drive consumer awareness for the category over the course of the next 6-18 months.”

Standalone will face challenges says the research firm due to extreme popularity in 2020 and 2021. However, tethered VR and AR glasses headsets will face a relatively easier path to growth due to the dearth of volumes in 2022. “Consumer VR usage has dominated the AR and VR market, but growing consumer interest in AR is starting to reshape that segment,” noted Ramon T. Llamas, research director for IDC’s Augmented and Virtual Reality research team.

Gaming for VR headsets

He continues: “Historically, commercial users have led the AR segment with training and field service applications. But with the advent of lighter form factors, brighter displays, crisp sound, and a growing list of titles, early adopters have swung the pendulum in the other direction. Combined with the widespread popularity of gaming for VR headsets, consumer usage will lead both segments even as the case for commercial usage grows.”